Why is DirecTV losing subscribers?

DirecTV, a long-standing titan in the satellite television industry, is experiencing a significant subscriber decline. This article delves into the multifaceted reasons behind this trend, exploring the competitive landscape, evolving consumer preferences, and technological advancements that are reshaping the entertainment ecosystem.

The Core Issue: A Shifting Entertainment Landscape

The question "Why is DirecTV losing subscribers?" is not a singular problem, but rather a symptom of a profound transformation in how consumers access and consume entertainment. For decades, satellite and cable television were the dominant forces, offering a curated bundle of channels delivered through a physical dish or cable line. This model, while once revolutionary, is now facing unprecedented challenges from a more flexible, personalized, and often more affordable digital landscape. DirecTV, as a prominent player in this legacy industry, is directly impacted by these seismic shifts. The core issue lies in the fundamental change in consumer expectations and the availability of superior alternatives that cater to modern viewing habits.

In 2025, the entertainment market is characterized by fragmentation and choice. Consumers are no longer content with monolithic packages that include dozens of channels they never watch. Instead, they demand control, personalization, and the ability to access content on their own terms, across multiple devices, and at a time that suits them. This shift has created a fertile ground for streaming services, on-demand platforms, and even over-the-air (OTA) broadcasts to chip away at the subscriber base of traditional pay-TV providers like DirecTV. The allure of lower costs, greater flexibility, and a more tailored viewing experience has led to a steady exodus of customers who once considered satellite TV an indispensable part of their home entertainment.

The very definition of "television" has evolved. It's no longer just about scheduled programming on a large screen. It's about binge-watching series on a tablet, catching up on news via a mobile app, or enjoying live sports on a laptop. This multi-platform, on-demand paradigm is where the new battle for eyeballs is being fought, and traditional providers like DirecTV, with their inherent infrastructure and business models, have struggled to keep pace with the agility and innovation of their digital counterparts.

Rising Costs and Diminishing Value Perception

One of the most significant drivers behind DirecTV's subscriber attrition is the escalating cost of its service, coupled with a perceived decline in its value proposition. Traditional pay-TV packages, including those offered by DirecTV, have historically been expensive. These bundles often include hundreds of channels, many of which are rarely, if ever, watched by the average subscriber. While the intention was to offer a comprehensive selection, this approach has become a liability in an era of targeted content consumption.

In 2025, consumers are more budget-conscious than ever. The combined cost of a DirecTV package, including equipment rental fees, installation charges, and potential regional sports surcharges, can easily run into hundreds of dollars per month. When compared to the more modular and often cheaper pricing structures of streaming services, the value proposition of a traditional satellite subscription begins to falter significantly. Many households find themselves paying for a vast array of content they simply do not consume, leading to a feeling of being overcharged for a service that doesn't fully meet their needs.

Furthermore, the rise of "skinny bundles" and à la carte streaming options has amplified this perception. Consumers can now cherry-pick the specific channels or content libraries they desire, often at a fraction of the cost of a full DirecTV package. For example, a sports enthusiast might opt for ESPN+ and MLB.TV, a movie buff might subscribe to Netflix and Max, and a news junkie might use CNN Go or MSNBC's streaming options. This granular approach to content acquisition allows individuals to curate their entertainment diets precisely, making the all-encompassing, one-size-fits-all model of satellite TV seem increasingly antiquated and inefficient.

The negotiation of carriage fees with content providers also plays a crucial role. When networks demand higher fees, these costs are inevitably passed on to the consumer. These price hikes, often occurring annually, further erode the perceived value of the service. A subscriber might find themselves paying more for the same set of channels, while simultaneously seeing competitors offer more compelling content at lower price points. This creates a negative feedback loop where rising costs lead to dissatisfaction, which in turn fuels the search for alternatives, ultimately resulting in subscriber churn.

The complexity of DirecTV's pricing structures can also be a deterrent. Hidden fees, promotional periods that expire, and confusing contract terms can lead to unexpected increases in monthly bills. This lack of transparency, when contrasted with the straightforward subscription models of most streaming services, contributes to a general sense of distrust and dissatisfaction among consumers. The expectation in 2025 is for clear, upfront pricing, and DirecTV's traditional billing methods often fall short of this standard.

Hidden Fees and Surcharges

Beyond the base subscription cost, DirecTV subscribers often encounter a variety of additional fees that inflate the monthly bill. These can include:

- Equipment Rental Fees: Charges for satellite receivers and DVRs, which can add a significant amount to the monthly cost, especially if multiple rooms are equipped.

- Regional Sports Surcharges: Fees levied to cover the cost of broadcasting local and regional sports networks, which can fluctuate and increase substantially.

- Broadcast TV Fees: Charges associated with the retransmission of local broadcast channels, which are often available for free over-the-air.

- Installation Fees: While sometimes waived for new subscribers, these can be a barrier for those who move or require new equipment.

- Late Fees and Other Administrative Charges: Standard charges that can add up if payments are missed or administrative issues arise.

These cumulative costs, often not fully disclosed upfront, contribute to the perception that DirecTV is an expensive service with a questionable return on investment.

Comparative Cost Analysis (2025)

To illustrate the cost disparity, consider the following simplified comparison:

| Service | Estimated Monthly Cost (2025) | Key Features |

|---|---|---|

| DirecTV (Mid-Tier Package) | $100 - $150+ | Hundreds of channels, live TV, DVR, some on-demand content. |

| Netflix (Standard Plan) | $15.49 | Vast library of movies and TV shows, original content, ad-free. |

| Max (Ad-Free) | $15.99 | HBO content, Warner Bros. films, DC universe, Discovery+ content. |

| Disney+ (with Hulu & ESPN+) | $14.99 (Bundle) | Family-friendly content, Marvel, Star Wars, live sports. |

| YouTube TV | $72.99 | Live TV channels, unlimited DVR, sports-focused. |

| Sling TV (Orange + Blue) | $55.00 | Customizable channel packages, live TV, affordable. |

This table highlights how a single streaming service can cost a fraction of a mid-tier DirecTV package. Even combining multiple popular streaming services often remains significantly cheaper than a comprehensive satellite subscription, especially when factoring in all the additional fees associated with DirecTV.

The Streaming Revolution: A Paradigm Shift

The advent and exponential growth of streaming services have fundamentally altered the entertainment landscape, presenting DirecTV with its most formidable challenge. Platforms like Netflix, Hulu, Amazon Prime Video, Disney+, Max, and a plethora of niche services have redefined how content is produced, distributed, and consumed. This "streaming revolution" is not merely a trend; it's a complete paradigm shift that has left traditional pay-TV providers scrambling to adapt.

Streaming services offer unparalleled convenience and flexibility. Users can access vast libraries of on-demand content anytime, anywhere, on virtually any internet-connected device. This "watch what you want, when you want" model directly contrasts with the scheduled programming and fixed viewing times inherent in traditional satellite TV. The ability to pause, rewind, and binge-watch entire seasons of shows without interruption is a luxury that satellite TV cannot replicate. In 2025, this level of control is not a novelty; it's an expectation.

The content itself has also become a major differentiator. Streaming services have invested heavily in producing high-quality original programming that garners critical acclaim and massive viewership. Shows like "Stranger Things" (Netflix), "The Last of Us" (Max), and "The Mandalorian" (Disney+) have become cultural phenomena, driving subscriptions and setting new benchmarks for television quality. These exclusive offerings create a strong incentive for consumers to subscribe to specific platforms, often leading them to abandon bundled satellite packages that may not carry these coveted shows or may charge extra for them.

Furthermore, the user experience on streaming platforms is generally more intuitive and personalized. Sophisticated algorithms recommend content based on viewing history, creating a tailored discovery experience. The interfaces are typically clean, modern, and easy to navigate, a stark contrast to the often clunky menus and interfaces of satellite set-top boxes. This focus on user-friendliness and personalization contributes to a more satisfying overall viewing experience.

The rise of live streaming options for sports and news has also chipped away at a traditional stronghold of pay-TV. Services like YouTube TV, Hulu + Live TV, and Sling TV offer live channels, including major sports networks and news outlets, often at a more competitive price point than DirecTV, and without the need for satellite installation. This provides an alternative for consumers who still want live programming but prefer the flexibility and cost-effectiveness of internet-based delivery.

On-Demand vs. Scheduled Programming

The fundamental difference in content delivery is a key factor:

- On-Demand: Consumers choose what to watch, when to watch it. This is the hallmark of streaming services.

- Scheduled Programming: Content is broadcast at specific times. While DirecTV offers DVR functionality, it still relies on a scheduled broadcast model at its core.

This shift favors the on-demand model, allowing individuals to fit entertainment into their busy lives rather than structuring their lives around television schedules.

Original Content and Exclusivity

The arms race for exclusive, must-watch content is fierce. Major streaming services are producing award-winning series and films that are only available on their platforms. For example:

- Netflix: Known for its vast library and breakout hits like "Squid Game" and "Wednesday."

- Max: Home to HBO's prestigious dramas and Warner Bros. blockbuster films.

- Disney+: The exclusive destination for Marvel, Star Wars, and Pixar content.

These exclusive titles are powerful magnets, drawing subscribers away from bundled services that lack such compelling original offerings.

User Experience and Personalization

Streaming platforms excel in user experience:

- Intuitive Interfaces: Easy navigation and search functions.

- Personalized Recommendations: Algorithms suggest content tailored to individual tastes.

- Cross-Device Compatibility: Seamless viewing across TVs, tablets, smartphones, and computers.

This user-centric design contrasts with the often more cumbersome interfaces of traditional set-top boxes.

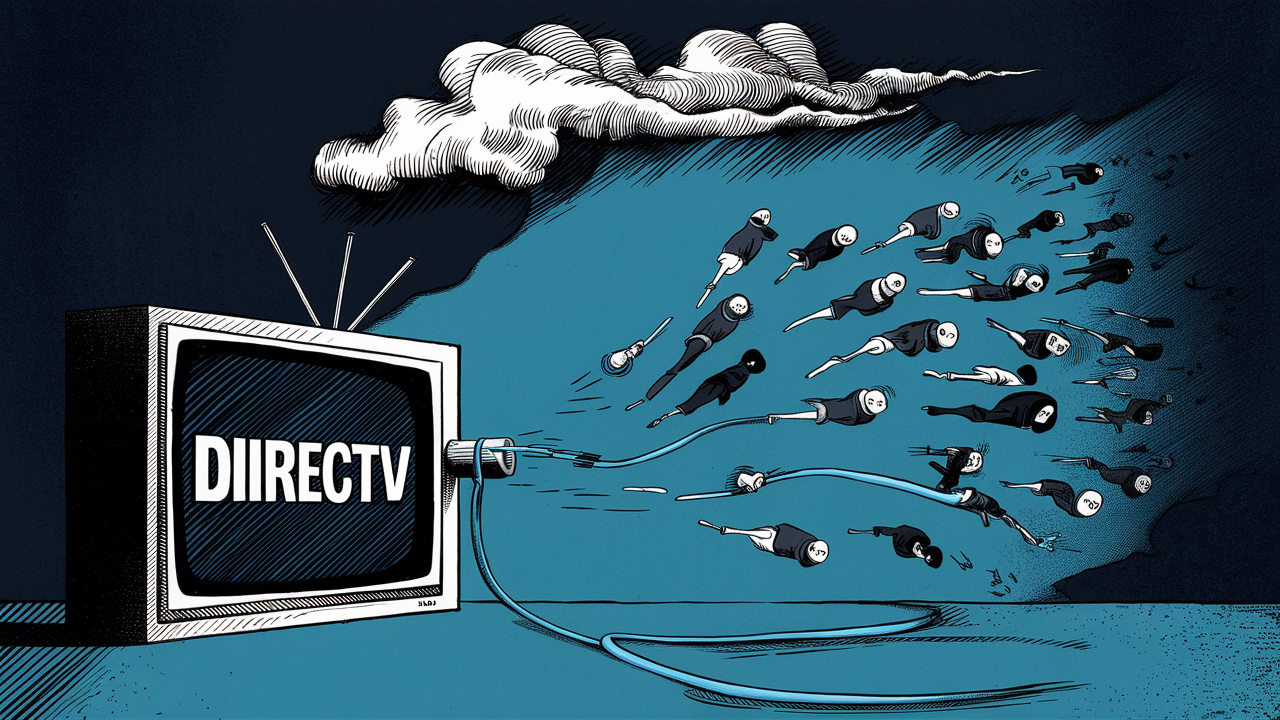

Cord-Cutting and Cord-Shaving: The Great Exodus

The terms "cord-cutting" and "cord-shaving" are central to understanding why DirecTV is losing subscribers. These phenomena represent a conscious decision by consumers to move away from traditional, expensive pay-TV subscriptions in favor of more flexible and cost-effective alternatives.

Cord-cutting refers to the complete cancellation of a traditional cable or satellite TV subscription. These individuals are opting out entirely, relying on a combination of streaming services, over-the-air (OTA) antennas for local channels, and potentially other internet-based entertainment options. The primary motivations for cord-cutting are typically cost savings and a desire for greater control over content selection. In 2025, cord-cutting is no longer a fringe movement; it's a mainstream behavior driven by the compelling value proposition of streaming.

Cord-shaving, on the other hand, involves reducing the number of channels or services within a traditional pay-TV package or switching to a less expensive, "skinny" bundle. This might mean downgrading from a premium DirecTV package to a more basic one, or perhaps keeping a satellite subscription but supplementing it heavily with streaming services. Cord-shavers are often still seeking some aspects of traditional TV, such as live sports or specific channels, but are actively trying to minimize their expenditure. They may also be doing so to offset the cost of multiple streaming subscriptions.

The combined effect of cord-cutting and cord-shaving creates a significant drain on DirecTV's subscriber base. As more households embrace these trends, the market share for traditional pay-TV providers shrinks. This exodus is fueled by several interconnected factors:

- Cost Savings: The most direct motivation. Replacing a $150+ DirecTV bill with a $50-$70 bundle of streaming services and an OTA antenna can result in substantial monthly savings.

- Content Flexibility: The ability to subscribe and unsubscribe to streaming services as desired, based on current interests (e.g., subscribing to a sports streaming service only during the season).

- Technological Superiority: The seamless integration of streaming across devices, the availability of on-demand content, and superior user interfaces.

- Availability of Alternatives: The sheer volume and quality of streaming services, plus the resurgence of OTA antennas for local channels, provide viable alternatives for nearly every type of viewer.

DirecTV's efforts to combat this trend, such as offering streaming-only options or more streamlined packages, have had limited success in stemming the tide. The ingrained perception of satellite TV as a legacy technology, coupled with the ongoing cost pressures, makes it difficult to retain subscribers who are actively seeking more modern and economical solutions.

Statistics on Cord-Cutting (2025)

While exact figures vary by research firm, the trend is undeniable. Projections for 2025 indicate continued losses for traditional pay-TV providers:

- Estimates suggest that millions of households have cut the cord in recent years, and this number is expected to grow.

- Some reports indicate that over 50% of U.S. households now subscribe to at least one streaming service, often in conjunction with or in place of traditional pay-TV.

- The decline in pay-TV subscribers, including satellite and cable, has been a consistent trend for the past decade, accelerating in recent years.

These statistics underscore the magnitude of the challenge DirecTV faces, as a significant portion of the market actively seeks alternatives to its core offering.

Examples of Cord-Cutting Strategies

A typical cord-cutting strategy in 2025 might look like this:

- Cancel DirecTV subscription.

- Purchase an Over-the-Air (OTA) Antenna: To receive local broadcast channels (ABC, CBS, NBC, FOX, PBS) for free. High-definition antennas are widely available and effective.

- Subscribe to Essential Streaming Services:

- Netflix: For general entertainment and popular series.

- Max: For premium HBO content and Warner Bros. films.

- Disney+: For family content, Marvel, and Star Wars.

- ESPN+: For a wide range of live sports and original sports content.

- Utilize Free Streaming Services: Platforms like Tubi, Pluto TV, and The Roku Channel offer free, ad-supported movies and TV shows.

- Consider Live TV Streaming Services (Optional): If live sports or a broader selection of live channels is crucial, services like YouTube TV or Sling TV can be added, often still at a lower cost than DirecTV.

This multi-pronged approach provides comprehensive entertainment options at a significantly reduced cost.

Technological Advancements and Viable Alternatives

The landscape of entertainment delivery has been irrevocably altered by technological advancements, creating a plethora of viable alternatives to traditional satellite television like DirecTV. These innovations have not only made streaming more accessible and appealing but have also empowered consumers with greater choice and control over their viewing habits.

High-Speed Internet and Wi-Fi: The widespread availability of reliable, high-speed internet is the bedrock of the streaming revolution. Faster download speeds and increased bandwidth mean that consumers can stream high-definition video content seamlessly without buffering or interruption. This infrastructure development has made internet-based entertainment a practical and enjoyable option for millions of households. The ubiquity of Wi-Fi in homes further enhances this by allowing content to be accessed on multiple devices wirelessly.

Smart TVs and Streaming Devices: The proliferation of Smart TVs, which come with built-in internet connectivity and app stores, has made accessing streaming services incredibly simple. For those with older televisions, affordable streaming devices like Roku, Amazon Fire TV Stick, Apple TV, and Google Chromecast offer a cost-effective way to transform any TV into a smart device. These devices provide a unified interface for accessing a multitude of streaming apps, consolidating content sources and simplifying the user experience.

Over-the-Air (OTA) Antennas: Contrary to popular belief, OTA antennas have experienced a resurgence in popularity. With the transition to digital broadcasting, modern antennas can receive a surprisingly large number of high-definition channels for free. For many households, an OTA antenna can provide access to local news, major network programming (ABC, CBS, NBC, FOX), and public broadcasting channels, reducing the need for a paid subscription for these basic services. The cost of a good OTA antenna is a one-time purchase, making it a highly economical solution.

Mobile Streaming: The increasing power and connectivity of smartphones and tablets have made mobile streaming a significant part of the entertainment ecosystem. Consumers can now watch live sports, catch up on shows, or stream movies on the go, further reducing their reliance on a fixed home entertainment system. Many streaming services offer robust mobile apps that are optimized for smaller screens and on-the-go viewing.

Gaming Consoles as Entertainment Hubs: Modern gaming consoles like PlayStation and Xbox have evolved beyond gaming. They now function as comprehensive entertainment hubs, offering access to streaming apps, web browsers, and even Blu-ray playback. This convergence means that many households already own a device capable of accessing a wide range of streaming content, further diminishing the perceived need for a separate satellite subscription.

These technological advancements have collectively lowered the barrier to entry for alternative entertainment options, making it easier and more affordable than ever for consumers to "cut the cord" and move away from traditional pay-TV. DirecTV's business model, built around satellite infrastructure and bundled channel packages, struggles to compete with the agility, cost-effectiveness, and user-centric design of these modern alternatives.

Over-the-Air (OTA) Antennas Explained

OTA antennas capture digital broadcast signals transmitted over the air. In 2025, with the digital transition complete, these signals are in high-definition (HD). Key benefits include:

- Free Local Channels: Access to major networks like ABC, CBS, NBC, FOX, and PBS in your area.

- No Monthly Fees: A one-time purchase cost for the antenna.

- Reliable Reception: Modern antennas can offer excellent reception, especially in urban and suburban areas.

- HD Quality: Broadcasts are typically in 1080p HD.

The cost of a good indoor or outdoor antenna typically ranges from $30 to $100, a fraction of a monthly DirecTV bill.

Streaming Devices vs. Set-Top Boxes

The comparison highlights the user-friendliness of modern alternatives:

| Feature | DirecTV Set-Top Box | Streaming Devices (Roku, Fire TV, Apple TV) |

|---|---|---|

| Interface | Often complex, menu-driven. | Clean, app-based, intuitive. |

| Content Access | Primarily live TV and DVR recordings. | Access to thousands of streaming apps, on-demand libraries, live TV streaming services. |

| Personalization | Limited. | Highly personalized recommendations and content discovery. |

| Portability | Fixed to a specific location. | Can be moved between TVs, used with laptops/tablets. |

| Cost | Monthly rental fees, part of subscription. | One-time purchase ($30 - $150), then subscription costs for services. |

The clear advantage in user experience and content access lies with streaming devices.

DirecTV's Response and Lingering Challenges

Recognizing the seismic shifts in the entertainment industry, DirecTV has attempted to adapt its strategies to mitigate subscriber losses. However, these efforts have faced significant challenges, often struggling to match the agility and appeal of streaming-native competitors. The company's response has been a mix of offering more streamlined packages, exploring streaming-only options, and attempting to leverage its existing infrastructure.

One of DirecTV's key initiatives has been the introduction of "skinny bundles" and more flexible programming options. This was an acknowledgment that the traditional all-encompassing packages were too expensive and did not cater to the diverse needs of consumers. By offering smaller, more curated channel lineups, DirecTV aimed to attract price-sensitive customers and those who were primarily interested in a subset of channels. However, these efforts have often been hampered by the continued presence of higher-priced legacy packages and the perception that even these "skinny" bundles are less cost-effective than comparable streaming options.

DirecTV has also ventured into the streaming-only space with services like DirecTV Stream (formerly AT&T TV). This platform offers live TV channels delivered over the internet, eliminating the need for a satellite dish and installation. It provides a more modern interface and aims to compete directly with services like YouTube TV and Hulu + Live TV. While DirecTV Stream offers a compelling alternative for those who want live TV without satellite, it still faces intense competition from established streaming players and often carries a premium price tag compared to some of its rivals.

Another challenge for DirecTV is its legacy infrastructure. The satellite dish and associated equipment, while once a technological marvel, are now seen by many as cumbersome and outdated. The installation process can be intrusive, and the equipment itself is less flexible than modern streaming devices. This reliance on physical infrastructure creates a higher overhead and a less adaptable business model compared to companies that operate purely in the digital realm.

Furthermore, DirecTV's brand perception is still largely tied to traditional satellite television. Shifting this perception to that of a modern, flexible entertainment provider is a significant marketing and branding challenge. Many consumers who have already cut the cord or are actively considering it may not even consider DirecTV as a viable option for their streaming needs, simply because of its historical association with satellite TV.

The ongoing battle for content rights also poses a challenge. As content providers increasingly launch their own direct-to-consumer streaming services, the availability of certain popular shows and movies on bundled packages can become fragmented. DirecTV must constantly negotiate complex carriage agreements, which can lead to disputes and channel blackouts, further frustrating subscribers.

Despite these efforts, DirecTV continues to face an uphill battle. The market has fundamentally shifted, and while the company is making attempts to adapt, it is operating from a position of legacy disadvantage. The core issues of cost, flexibility, and the overwhelming appeal of streaming alternatives remain significant hurdles to overcome.

DirecTV Stream: An Internet Alternative

DirecTV Stream represents DirecTV's most direct attempt to compete in the internet-delivered TV market. Key features include:

- No Satellite Dish Required: Delivered via broadband internet connection.

- Live TV Channels: Offers a wide range of channels comparable to traditional packages.

- Cloud DVR: Allows users to record and watch programs on demand.

- Multiple Tiers: Various packages available to suit different needs and budgets.

However, it often faces criticism for being priced higher than some competitors like YouTube TV or Sling TV, and still requires a stable internet connection.

Challenges in Adapting Legacy Infrastructure

DirecTV's reliance on satellite technology presents several inherent challenges:

- Installation Complexity: Requires professional installation of a satellite dish.

- Equipment Costs: Monthly rental fees for receivers and DVRs.

- Weather Dependence: Satellite signals can be affected by severe weather.

- Limited Flexibility: Less adaptable to new technologies compared to software-based streaming.

These factors make it harder for DirecTV to compete with the plug-and-play simplicity of streaming devices.

Competitor Analysis: Where Are Subscribers Going?

Understanding why DirecTV is losing subscribers necessitates a close examination of where those departing customers are ultimately finding their entertainment. The competitive landscape is diverse and dynamic, with various players vying for consumer attention and dollars. The primary destinations for former DirecTV subscribers fall into several key categories:

1. Major Streaming Platforms: This is by far the largest category. Services like Netflix, Max, Disney+, Amazon Prime Video, and Apple TV+ are attracting a significant number of cord-cutters. These platforms offer vast libraries of on-demand content, critically acclaimed original series, and blockbuster movies. Their subscription models are flexible, allowing users to subscribe and unsubscribe as needed, and their pricing is generally more affordable than traditional pay-TV packages.

2. Live TV Streaming Services: For consumers who still desire the experience of live television, particularly sports and news, live TV streaming services have become the go-to alternative. YouTube TV, Hulu + Live TV, Sling TV, and FuboTV offer packages of live channels delivered over the internet. These services often provide unlimited cloud DVR storage and a more modern user interface than traditional providers. They are particularly attractive to sports fans who want to follow multiple leagues and events without the high cost and inflexibility of satellite packages.

3. Niche Streaming Services: Beyond the major players, a growing number of niche streaming services cater to specific interests. Examples include Shudder (horror), Crunchyroll (anime), BritBox (British television), and Peacock (NBCUniversal content, including live sports and originals). These services allow consumers to tailor their entertainment subscriptions precisely to their passions, further reducing the need for a broad, expensive bundle.

4. Over-the-Air (OTA) Broadcasts: As mentioned previously, the resurgence of OTA antennas allows consumers to receive local broadcast channels for free. This covers local news, network primetime shows, and major sporting events broadcast on networks like CBS, NBC, and FOX. For many, this provides a sufficient baseline of free content, reducing their reliance on paid subscriptions.

5. Hybrid Approaches: Many former DirecTV subscribers are not opting for a single alternative but rather a combination. This might involve an OTA antenna for local channels, a subscription to Netflix for general entertainment, and perhaps a live TV streaming service like Sling TV for specific sports or news channels. This hybrid model offers maximum flexibility and cost control.

The key takeaway is that consumers are seeking value, flexibility, and content relevance. DirecTV's competitors are succeeding by offering these attributes in a more modern, accessible, and often more affordable package. The trend indicates a clear preference for digital, on-demand, and customizable entertainment solutions over the legacy, bundled model that DirecTV has historically represented.

Market Share Shifts (2025)

The ongoing shift in market share is evident:

- Streaming Services: Dominating growth, with major platforms consistently adding subscribers.

- Live TV Streaming: Steady growth, attracting users who want live TV but not satellite.

- Traditional Pay-TV (Cable/Satellite): Experiencing consistent, significant subscriber losses.

This data strongly suggests that consumer preference has decisively moved towards internet-delivered video services.

Key Competitor Offerings

A brief look at what competitors offer:

- Netflix: Massive on-demand library, original series, movies.

- YouTube TV: Comprehensive live TV channel lineup, unlimited DVR, sports focus.

- Sling TV: Customizable, affordable live TV packages.

- Max: Premium HBO content, Warner Bros. films, DC universe.

- Disney+: Family-friendly content, Marvel, Star Wars.

These services provide a focused value proposition that DirecTV often struggles to match across its broad, bundled offerings.

The Future of Traditional Pay-TV

The trajectory for traditional pay-TV providers like DirecTV is clear: continued subscriber decline. The fundamental business model, built around delivering a bundled package of linear channels via satellite or cable, is increasingly out of step with modern consumer preferences and technological capabilities. While these companies are making efforts to adapt, the challenges are profound and deeply ingrained.

In 2025, the market is dominated by the flexibility, personalization, and cost-effectiveness of streaming. Consumers have become accustomed to on-demand access, curated content libraries, and the ability to switch services easily. The high costs, bundled offerings, and often clunky user interfaces of traditional pay-TV are significant deterrents. The ongoing "cord-cutting" and "cord-shaving" trends are not temporary fads but rather a permanent shift in how people consume entertainment.

For DirecTV and similar companies, the future likely involves a significant transformation or a gradual decline. Survival may depend on:

- Aggressive Pivot to Streaming: Doubling down on internet-delivered services like DirecTV Stream, making them more competitive in pricing and features.

- Leveraging Existing Assets: Exploring ways to utilize their content rights and infrastructure for new digital ventures.

- Strategic Partnerships: Collaborating with technology companies or content creators to offer more integrated and appealing packages.

- Focusing on Niche Markets: Potentially serving specific demographics or regions where satellite or cable remains a preferred option, though this market is shrinking.

However, the inertia of legacy infrastructure and established business practices makes rapid adaptation difficult. The market has moved on, embracing a more agile, digital-first approach to entertainment. Unless traditional pay-TV providers can fundamentally reinvent themselves and shed the constraints of their past, their role in the future of home entertainment will likely be diminished.

The era of mandatory, expensive channel bundles is drawing to a close. The future belongs to services that offer choice, value, and a superior user experience, delivered through the internet. DirecTV's struggle to retain subscribers is a clear indicator of this evolving reality, and the company faces a challenging road ahead as it navigates this transformative period in media consumption.

Ultimately, the question of "Why is DirecTV losing subscribers?" is answered by the overwhelming consumer preference for a more modern, flexible, and cost-effective entertainment ecosystem that streaming services have expertly cultivated. The traditional pay-TV model, while once dominant, is struggling to keep pace with innovation and changing consumer demands.

Conclusion:

DirecTV's subscriber losses are a direct consequence of a rapidly evolving entertainment landscape. The confluence of rising costs, the undeniable appeal of streaming services with their vast content libraries and original programming, and the widespread adoption of cord-cutting strategies have created an insurmountable challenge for traditional pay-TV models. Technological advancements in internet speed and streaming devices have further empowered consumers with more affordable and flexible alternatives. While DirecTV has attempted to adapt with streaming-only options, its legacy infrastructure and brand perception present significant hurdles. To stem the tide, DirecTV must continue to innovate, focusing on delivering unparalleled value and a superior user experience that directly competes with the agility and cost-effectiveness of its digital counterparts. For consumers, the current environment offers unprecedented choice and the opportunity to curate personalized entertainment experiences at a fraction of the cost of traditional packages.